A Shifting Landscape for U.S. Disposable Glove Imports

The U.S. disposable glove market has undergone dramatic shifts during the first seven months of 2025. Vinyl glove imports rebounded sharply in July, medical-grade nitrile and latex gloves posted steady growth, and industrial-grade products surged at record pace. These movements reflect how closely the industry responds to tariff changes, global supply chain adjustments, and evolving procurement strategies.

Despite strong summer performance, the year-to-date totals still reflect earlier declines, revealing the lingering impact of restrictive tariff policies and cautious purchasing behaviors. Distributors and buyers continue to monitor how the market realigns in real time.

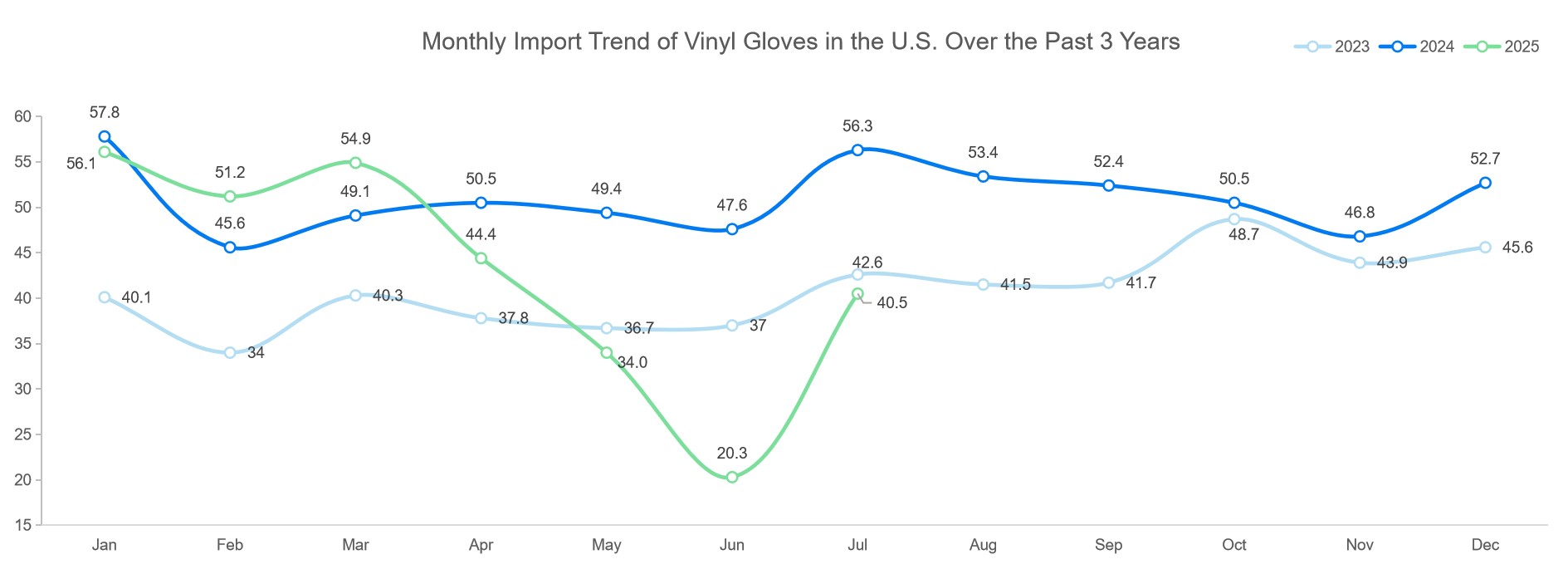

Vinyl Gloves: A Remarkable Monthly Rebound

July 2025 saw vinyl glove imports reach 4.05 billion units—a 99.5% increase from the previous month. This rebound was largely fueled by the relaxation of U.S.–China tariff policies, which unlocked pent-up demand among importers. At the same time, Chinese manufacturers quickly scaled production to take advantage of renewed opportunities.

Still, the cumulative total for January–July, at 30.14 billion units, remains 15.4% below the same period in 2024. Much of the earlier weakness stemmed from tariffs that restrained shipments during the first half of the year.

China remains the near-exclusive supplier for vinyl gloves, holding a 90.8% share of all U.S. imports. Limited capacity in Vietnam and other countries has done little to diversify sourcing, leaving buyers heavily reliant on Chinese supply. This concentration exposes the segment to ongoing trade and policy risks.

Medical-Grade Gloves Maintain Steady Growth

Medical-grade nitrile and latex gloves continued on a steady upward trajectory. Imports reached 6.38 billion units in July, up 2.7% from June. The total for the first seven months hit 44.06 billion units—representing a healthy 10% year-over-year increase. This growth reflects enduring demand for high-quality protection across U.S. healthcare facilities.

The sourcing map, however, has shifted dramatically. China’s share of medical nitrile and latex glove imports plummeted from 38.9% in 2024 to just 2.8% so far in 2025. U.S. buyers have pivoted strongly toward Southeast Asia: Malaysia now supplies 67.5% of imports, Thailand 16.9%, and Vietnam 9.8%. These countries have succeeded in scaling output while meeting FDA medical glove requirements.

Meeting Regulatory Standards

For medical products, compliance remains non-negotiable. Medical gloves are classified as Class I devices that require 510(k) premarket notification before being sold in the U.S. Beyond FDA approval, gloves must comply with international benchmarks such as ASTM D6319 standards for nitrile exam gloves. These frameworks ensure durability, barrier performance, and acceptable quality levels.

The FDA also enforces strict import oversight. Through tools like Import Alert 80-04, gloves failing to meet requirements may be detained without physical examination. Buyers thus depend on trusted suppliers who can guarantee compliance and avoid costly disruptions.

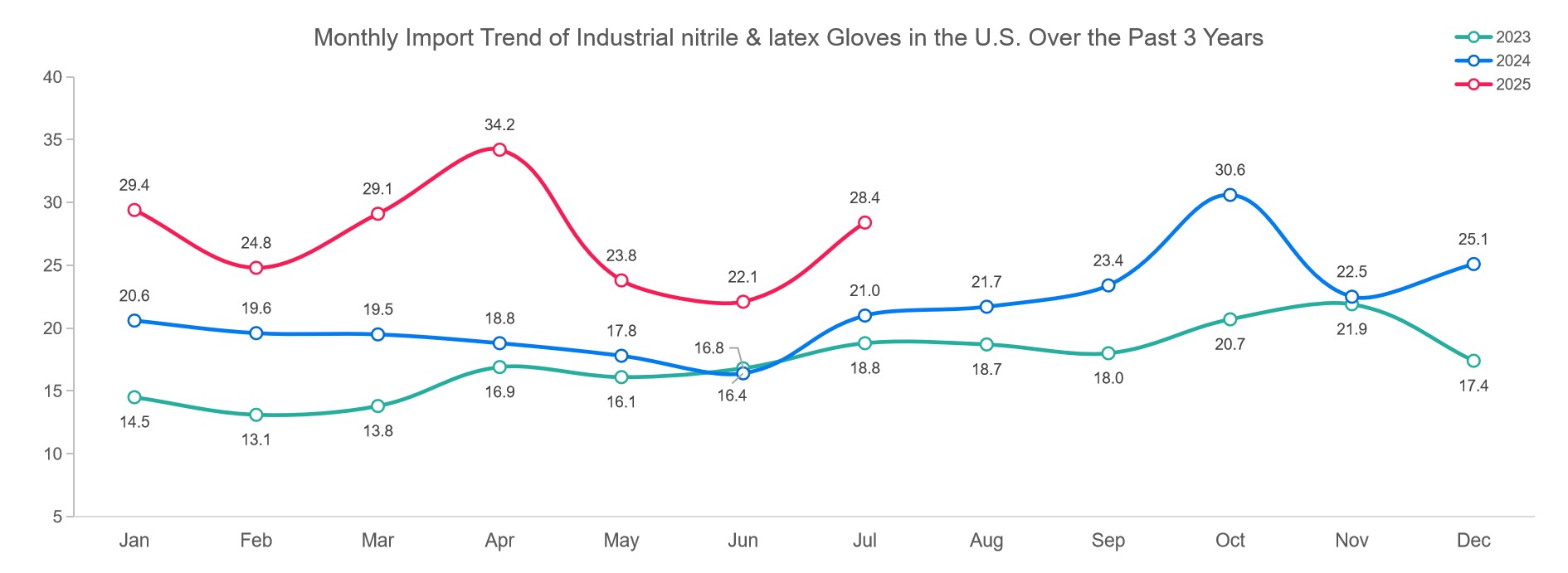

Industrial Gloves Surge on Tariff Advantages

The industrial glove market has recorded the strongest momentum of all categories. July imports jumped 28.5% to 2.84 billion units, bringing the January–July total to 19.18 billion units—an extraordinary 43% increase year-over-year.

This growth is fueled by tariff arbitrage: industrial-grade gloves face significantly lower import duties than medical-grade equivalents. For many non-medical applications, functionality outweighs the need for medical certification, leading to a strategic shift toward industrial options. According to U.S. Customs guidance on surgical glove imports, tariff levels remain a central driver of procurement decisions.

Sourcing patterns for industrial gloves are more diversified than those for vinyl. Malaysia continues to lead with 39.9% of U.S. imports, followed by Thailand (27.5%), Vietnam (11.0%), Indonesia (7.3%), and China (11.6%). Lower duties for industrial goods have helped China maintain a modest foothold in this segment despite steep declines in medical-grade shipments.

What It Means for Buyers and Distributors

The current market underscores two clear realities:

-

Supply diversification is essential. Over-reliance on one country exposes buyers to policy and tariff risks.

-

Compliance and quality remain central. Medical buyers, in particular, cannot compromise on FDA and ASTM standards.

Navigating this complex landscape requires working with large, vertically integrated manufacturers who can deliver stable supply, competitive pricing, and proven regulatory adherence.

Spotlight on INTCO Medical: Scale, Reliability, and Innovation

Against this backdrop, INTCO Medical has emerged as a key partner for U.S. buyers. As a global leader in glove production, the company combines scale, vertical integration, and quality assurance to serve both medical and industrial markets.

The Largest Latex-Free Medical Gloves Manufacturer

In a marketplace shaped by tariffs, shifting supply bases, and rising compliance demands, aligning with a proven partner is vital. INTCO Medical has built its reputation on reliability, regulatory excellence, and innovation. Today, the company is recognized as the largest latex-free medical gloves manufacturer, delivering trusted protection to healthcare providers and industries worldwide.

As the U.S. glove market continues to evolve through 2025 and beyond, distributors and buyers who partner with INTCO Medical can be confident in securing a stable, compliant, and future-ready supply chain.