China’s latest export data on disposable gloves for January through July 2025 reveals emerging regional preferences and material trends critical to global healthcare, industrial, and general-use markets. While vinyl gloves experienced a moderate decline overall, medical-grade nitrile and latex products demonstrated robust growth—revealing nuanced demand across North America, Europe, and Asia. This overview highlights key figures, material insights, and implications for manufacturers like INTCO Medical as they meet evolving global needs.

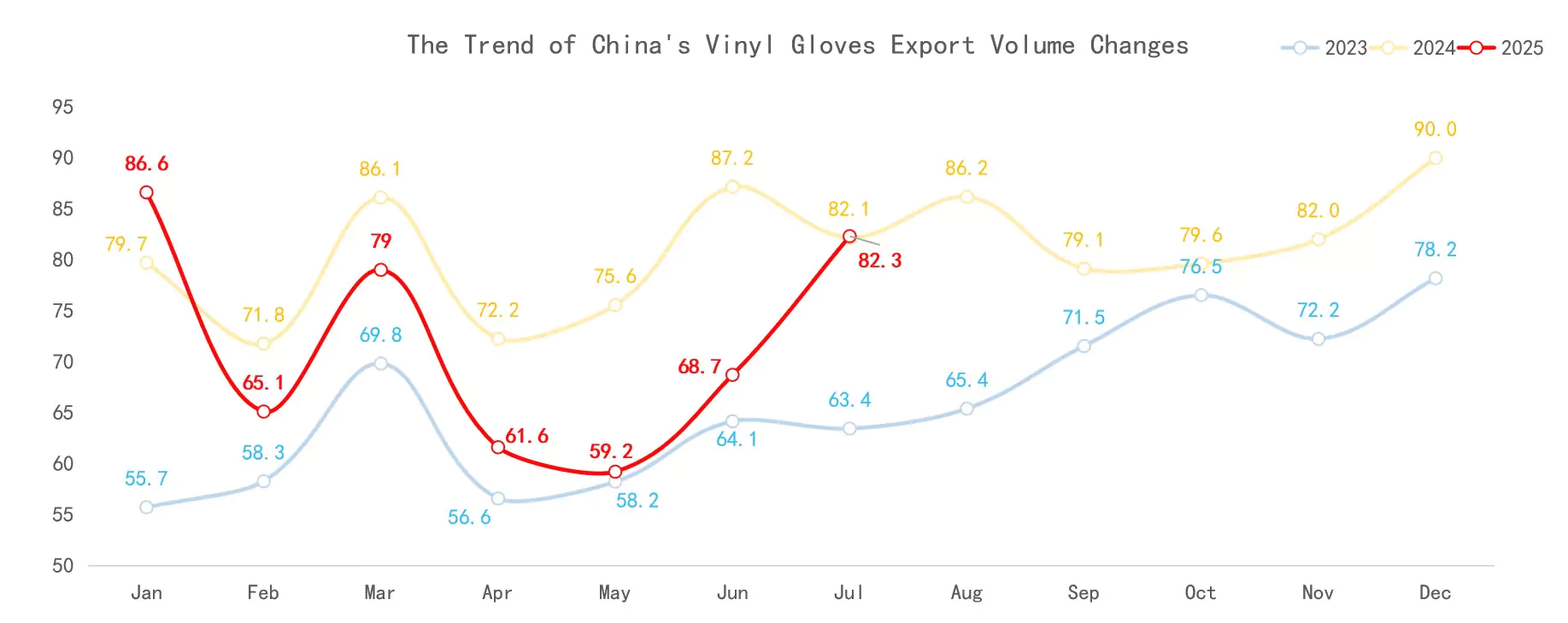

Vinyl Gloves: North America Holds Firm Despite Slight Overall Decline

China exported approximately 50.25 billion vinyl gloves in the first seven months of 2025, marking a 9.4% year-on-year decrease. However, July alone showed resilience with 8.23 billion units shipped, rising 19.8% month-to-month and slightly above July 2024, signaling a possible rebound trend.

Regionally, North America dominated, absorbing 45.9% of all vinyl exports (around 23.05 billion units)—driven by demand in healthcare, food service, and household sectors. Following suit were Japan and South Korea (16.4%) and Europe at 15.8%, while the Middle East, Oceania, and South America shared smaller portions. At the country level, the U.S. led with 20.94 billion units (41.7%), followed by Japan, Saudi Arabia, the UK, and Canada.

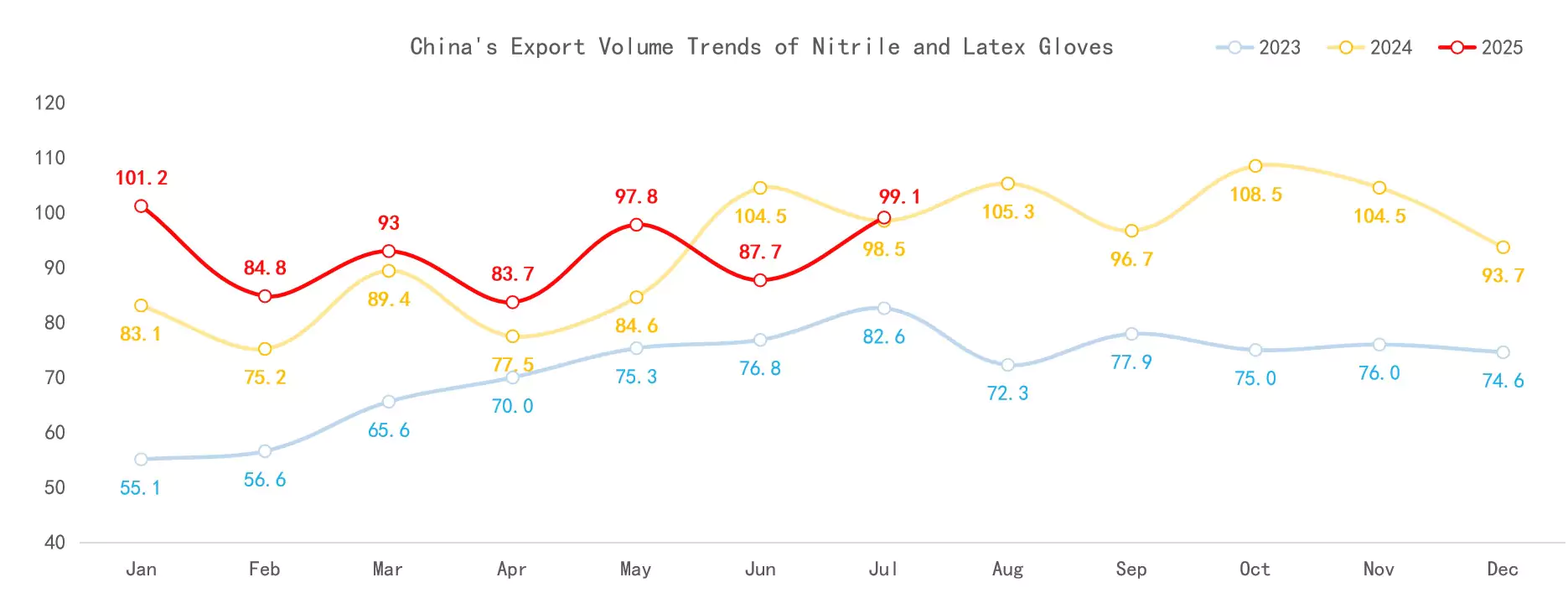

Nitrile & Latex Gloves: Medical-Grade Demand Fuels Growth

In contrast to vinyl, nitrile and latex glove exports rose to 64.72 billion units in January–July—a solid 5.6% increase year-on-year, with 9.91 billion dispatched in July alone (+13% from June).

Medical-Grade Segment: Europe Takes the Lead

Medical-grade products comprised 71% of total nitrile and latex exports (about 45.9 billion units). Europe accounted for 65.5% of this category (approximately 30.07 billion units), underlining its stringent healthcare standards and continued investment in infection control.

Among European importers, Germany topped the list with 6.75 billion units (14.7%), followed by the UK (4.01 billion, 8.7%) and Poland (3.59 billion, 7.8%). Emerging gains were seen in Italy and Brazil, while Spain slipped slightly in rankings.

Industrial-Grade Segment: U.S. and Asia Fuel Demand

Industrial-grade nitrile and latex, used in manufacturing, automotive, and chemical handling, comprised 29% of exports (18.83 billion units). The U.S. led with 3.13 billion (16.6%), followed by Japan (2.56 billion, 13.6%).

Material innovations expand applications: for instance, Syntex Synthetic Latex Gloves offer improved durability and wearer comfort, catering to diverse industrial needs.

Market Dynamics: Three Key Insights

China’s 2025 export data underscores three major trends:

-

Material divergence: Vinyl underperformed relative to nitrile and latex, which grew thanks to stronger safety performance and chemical resistance.

-

Regional concentration: North America remains the backbone of vinyl demand, Europe leads in medical-grade nitrile/latex, and Asia—including the U.S.—drives industrial requirements.

-

Leading importers remain stable: The U.S., Germany, and Japan continue to anchor global exports, though mid-tier markets are shifting.

These patterns emphasize the necessity of flexibility in global supply chains—from healthcare-grade sterilization to heavy-duty industrial resilience—while also prompting manufacturers to invest in sustainable materials and adherence to evolving regulatory standards, such as those outlined by the European Medicines Agency. For official U.S. regulatory benchmarks, the FDA maintains glove standards and certifications.

Strategic Implications and the Role of INTCO Medical

In this increasingly segmented market, manufacturers benefit from agility, innovation, and scale. One standout player is INTCO Medical, recognized as the largest latex-free disposable gloves manufacturer, offering a broad portfolio that spans vinyl, nitrile, and synthetic latex lines.

INTCO caters to diverse needs: for supply chain partners, it provides custom OEM services, ESG-aligned operations, and superior logistics across global markets. The company’s Syntex Synthetic Latex Gloves exemplify the union of latex elasticity and nitrile resistance, serving high-risk medical and industrial environments with minimal allergy risk.